are union dues tax deductible in ny

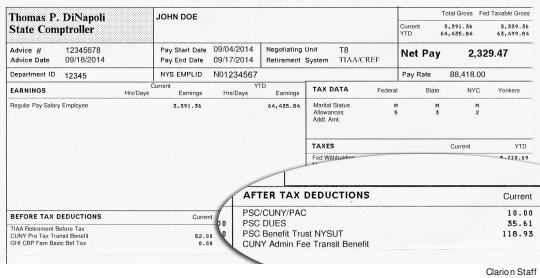

In the new state budget agreement unions lobbied for and won a provision that will allow private- and public-sector union members to deduct the cost of their union dues from their New York State taxes. Members should print this pay check and reference the box entitled After Tax Deductions.

Are You A Union Member Psc Cuny

The union dues will automatically be transferred over to your IT-196 which is your resident nonresident and part-year resident itemized deductions form onto line 21 Unreimbursed Employee Expenses - job travel union dues etc.

. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020. The FY 2018 Enacted Budget creates a union dues deduction for New York taxpayers who itemize deductions at the state level equal to the amount currently disallowed at the federal level due to the 2 percent floor. For federal purposes your total itemized deduction for state and local taxes paid in 2021 is limited to a combined amount not to exceed 10000 5000 if married filing separateIn addition you can no longer deduct foreign taxes you paid on real estate.

The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an employee can itemize. Its important that you do not claim your tax deduction for union dues. Tuesday March 19 2019.

Monday Friday 9am to 3pm. Most UFT members who itemize deductions on their federal and state tax returns will save 140 if they. Andrew Cuomo slipped in a sweetener for unions.

Unfortunately while they are technically 100 deductible this year they are only such if you Itemize your returns on your New York state return. If your Standard Deduction is still higher than the sum of all of your Itemized Deductions it will automatically apply your standard deduction on line 34 of your New York IT-201 return in. The bill also provided 160 million in wage increases for some direct car workers and changes to.

On April 10 New York passed a law allowing union dues and agency fees to be completely tax deductible effectively giving a tax break to union members. Please note that tax payers can now itemize. Also even though unreimbursed.

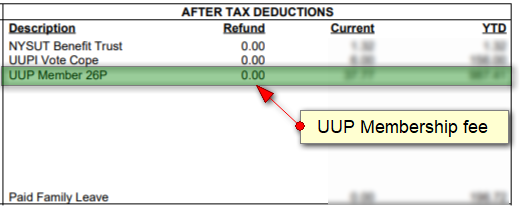

Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions. A reminder for tax season. If you and your spouse.

Unfortunately while union dues are technically 100 deductible this year they are only such if you Itemize your returns on your New York state return. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. For New York purposes Form IT-196 lines 5 6 and 7 your state and local taxes paid in 2021 are not subject to the.

Post date January 19 2021. New Yorks highest-paid union workers will be the chief beneficiaries of a tax break slipped into the state budget that makes their dues fully. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too.

Educator expense tax deduction renewed for 2020 tax returns. Two years ago the New York State AFL-CIO along with unions across the State of New York fought for legislation that would allow union members to deduct union dues on state income taxes. You may claim a tax deduction on line 21200 of your tax return and if your employer is a GSTHST registrant you may be able to claim a refund for a portion of your union dues.

Out of the clear blue sky a provision making labor union dues fully deductible for state personal income tax. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. The New York State tax deduction will benefit more workers because it does not set a minimum threshold amount that must be exceeded for union dues to be deductible.

Union dues may be tax deductible subject to certain limitations. Deducting Union Dues On NYS Taxes. Post author By Kristen.

The ability for unions to deduct dues from their state personal income taxes. Tax reform changed the rules of union due deductions. The new legislation which Governor Cuomo signed in May as part of the FY 2018.

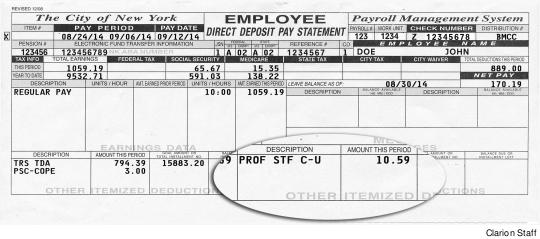

The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44. The deduction is expected to save 500000 hardworking men and women 35 million annually or about 70 per taxpayer per year. 31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated.

We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. The Governors Office estimates that the deduction will save 500000 workers about 70 per year. During the year ending Dec.

State tax deduction for your union dues Share This As a result of legislation championed by NYSUT the state AFL-CIO and other unions across the state signed into law 42017 union members in New York can deduct their union dues from the state income taxes if they itemize. As a result of the legislation passed and signed into law in April 2017 union members in the state of New York will have the opportunity to deduct their union dues from their state income taxes. New York union dues are now fully tax deductible under a state budget provision backed by Gov.

In contrast if a taxpayer is self-employed and pays union dues then they are deductible as a business expense. In the late-hour last-minute haggling that often defines New Yorks state budget negotiations Gov. Two years ago the New York State AFL-CIO with support from unions across the state led the charge for this legislation.

New Yorks union dues deduction measure was included in the 2017 overall budget bill.

Solved Where Do I Enter New York State Teacher Union Dues For Nys Taxes

The Wandering Tax Pro What S New For 2018 Tax Forms New York

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Twu Local 100 New York S Public Transit Union

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association

Union Dues Are Now Tax Deductible Foa Law

Solved On New York State Income Tax Return Van I Take A

Union Dues Now Tax Deductible Ibew 1249

Nys Afl Cio Union Dues Now Deductible From State Income Taxes Twu Local 100

Solved Can We Still Deduct Electrical Union Dues And The Additional Work Assessment Fees That We Used To Itemize On Either Our Federal Return Or On The Minnesota Return

Deduct Your Union Dues At Tax Time New York State Afl Cio

Are You A Union Member Psc Cuny

Bill Seeks To Make Union Dues Tax Deductible Iam District 141